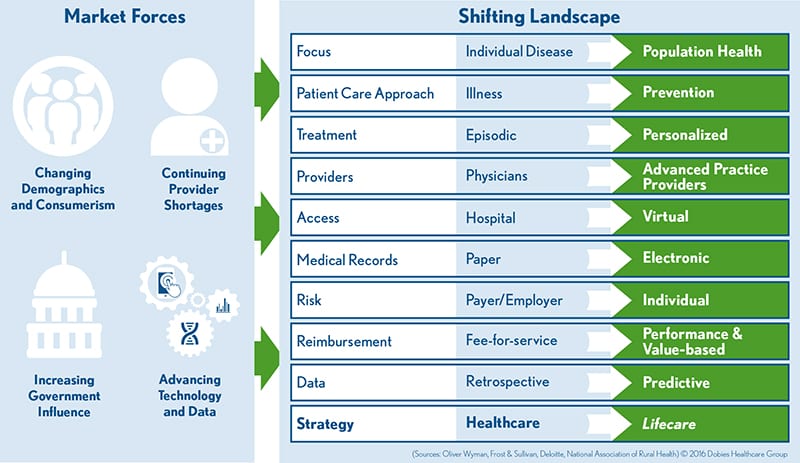

Together with HealthScape Advisors, we recently coauthored a white paper called, The Emerging Lifecare Model: How consumerism is driving industry collaboration toward health and lifecare as a new strategic platform. In the paper, we explore how healthcare strategies are shifting, creating a transformation in the financing and delivery of consumer services.

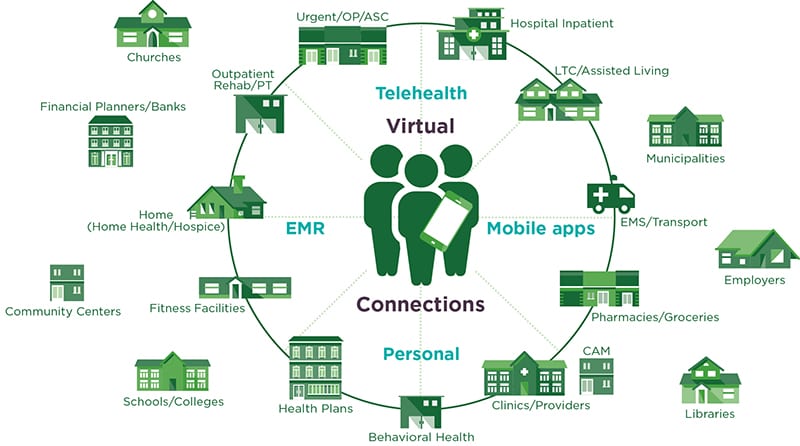

Think of lifecare as a new, consumer-centric ecosystem, one that offers integrated health-related services across the full continuum of consumer needs. One key industry driver is a knowledge shift—from consumers as passive recipients of healthcare information to consumers as active, informed participants in health and wellness.

This fundamental shift in how consumers acquire and value knowledge is transforming how healthcare is delivered—and it represents a trend that transcends healthcare as well. Industries of all kinds are adopting platform strategies that allow consumers to take center stage and command a stronger presence in the marketplace than ever before.

Platform Strategy: Value through Consumer-Centric Connectivity

Before the Apple iPhone made its debut, five mobile phone manufacturers dominated the industry, controlling 90% of mobile phone profits worldwide, according to Harvard Business Review. These five major players—Ericsson, LG, Motorola, Nokia and Samsung—were seemingly here to stay, while the iPhone was little more than a twinkle in Apple’s eye. In 2007, the introduction of the iPhone changed everything, and within eight years, the iPhone took its place as the dominant global leader in the mobile phone space, controlling 92% of global profits by 2015.

How did Apple do it—was the iPhone so groundbreaking that it sent others on the path to near irrelevancy? Was iPhone technology far superior to the competition? The answer is yes…and no. On the surface, the core product was not much different than its competitors. It was not the first smartphone, and initially it could not run third-party apps. The iPhone made phone calls and took decent pictures; it delivered the same basic functionality as the other devices.

What was groundbreaking—and what drove the other, once-innovative devices to the brink of irrelevance—was Apple’s strategic approach. Rather than producing a device that connected people for communication and commerce (a pipeline strategy), Apple created a product based on a broader platform strategy—an ecosystem that creates value for participants by connecting them across the spectrum, from producers (e.g., app developers) to consumers, while providing the consumer with ever-increasing options and control.

What was groundbreaking—and what drove the other, once-innovative devices to the brink of irrelevance—was Apple’s strategic approach. Rather than producing a device that connected people for communication and commerce (a pipeline strategy), Apple created a product based on a broader platform strategy—an ecosystem that creates value for participants by connecting them across the spectrum, from producers (e.g., app developers) to consumers, while providing the consumer with ever-increasing options and control.

Apple began welcoming others to develop on its platform and opening itself to a community of innovators, providing a centralized location for every participant to connect and experience value on their own terms. Rather than trying to control the customer experience, Apple focused on facilitating connections and opening a vast new realm of possibilities, particularly after its App Store launched in 2008 (when more than 10 million apps were downloaded the first weekend). The App Store, even in its earliest and most primitive versions, is a clear example of platform strategy.

Companies such as Apple, Uber, Amazon and Airbnb deliver value through platforms—they are connecting consumers with producers and providing myriad choices traditional “pipeline” companies cannot deliver without significant shifts in strategy. In addition, platforms can provide a transparent channel for customers to give feedback on products, further motivating producers to provide positive experiences. In this model, the consumer is at the center, and has a degree of choice and control that was once inconceivable.

This model is equally applicable to healthcare. Epic Systems Corporation recently announced its shift from Electronic Health Records to “Consumer Health Records” (CHRs). Epic CEO Judy Faulkner, in an interview with Healthcare IT News, discussed the company’s approach, which includes, “removing the barriers between clinics, hospitals, and other areas of consumers’ lives” to create a more collaborative, consumer-centric platform. This move signals a larger shift, one that uses software as a “central nervous system” to connect otherwise disparate patient information (such as social health determinants, eating and sleeping habits, and other factors that impact health)—all with the consumer at the center.

Another example is Brighter, a healthcare software company. Through its Digital Health Plan Platform™, Brighter seamlessly connects patients, providers and payers using a single platform to:

- Empower consumers with price, quality and service transparency, verified patient reviews, online appointment scheduling and electronic appointment reminders

- Enable providers to maximize participation in carrier networks by more efficiently and effectively marketing their practices to new patients and maintaining direct connections with existing patients

- Help health insurance carriers and benefit plan administrators increase member satisfaction and engagement while reducing costs

In December 2017, Cigna announced its acquisition of Brighter. Building on the existing relationship between the companies, Brighter’s digital health platform will allow Cigna to accelerate and expand its provider partnerships and consumer initiatives.

Another recent example involving Apple, three leading EHR providers (Epic Systems, Cerner and AthenaHealth), and 12 medical institutions across the country illustrates how Apple continues to pursue and expand its platform strategy, specifically in the health space. The functionality on Apple’s preinstalled Health app, still in beta, will allow users to access medical records from participating clients—including Penn Medicine, Cedars-Sinai Medical Center, Johns Hopkins, Geisinger Health System and others across the country—as well as at Cerner’s onsite employee health clinics in Kansas City. By linking the Apple Health app with various patient portals, users will be able to view their allergy information, immunization records, lab results, prescriptions, vitals and procedure details, along with other metrics in the app like steps, sleep and nutrition.

According to Apple.com news, leaders at both Apple and Cedars-Sinai say the primary goal for this initiative is empowering consumers to live healthier lives by making sure each individual has access to his or her own medical/health information.

Consumer-Centric Platforms as Strategic Imperatives

Platform strategies may use physical platforms, such as websites, portals, apps and other tangible assets. They may involve formal or informal partnerships that facilitate collaboration between multiple entities, such as a hospital, clinic, community health center or local government (or some combination therein). They may also include nontraditional players who are now entering the healthcare space.

Whatever the structure, it’s important to realize that technology—and the way individuals acquire and consume knowledge—is driving a transformation in strategy. It is changing the way industries design products and deliver services. Companies that keep consumers at the center of their ecosystem will ultimately emerge as industry and market leaders.

About the Authors

Carol Dobies, CEO and Founder of Dobies Health Marketing, has been bringing healthcare brands to life for 35+ years. Carol co-authored this article with Julie Amor, President and Chief Strategy Officer for Dobies Health Marketing, bringing more than 20 years of experience elevating healthcare brands to our firm and our clients.

Carol Dobies, CEO and Founder of Dobies Health Marketing, has been bringing healthcare brands to life for 35+ years. Carol co-authored this article with Julie Amor, President and Chief Strategy Officer for Dobies Health Marketing, bringing more than 20 years of experience elevating healthcare brands to our firm and our clients.

Share your thoughts about this article by tweeting @DobiesGroup or commenting on our Facebook page.

There has been a notable uptick in consumer use of products, services and web/mobile applications that cater to their increasing desire to maintain an overall healthy state of being. The connected wearable device category alone reached 453 million users in 2017, and it is projected to nearly double by 2021 (findings available

There has been a notable uptick in consumer use of products, services and web/mobile applications that cater to their increasing desire to maintain an overall healthy state of being. The connected wearable device category alone reached 453 million users in 2017, and it is projected to nearly double by 2021 (findings available

In our first #lifecare series

In our first #lifecare series

What was groundbreaking—and what drove the other, once-innovative devices to the brink of irrelevance—was Apple’s strategic approach. Rather than producing a device that connected people for communication and commerce (a pipeline strategy), Apple created a product based on a broader platform strategy—an ecosystem that creates value for participants by connecting them across the spectrum, from producers (e.g., app developers) to consumers, while providing the consumer with ever-increasing options and control.

What was groundbreaking—and what drove the other, once-innovative devices to the brink of irrelevance—was Apple’s strategic approach. Rather than producing a device that connected people for communication and commerce (a pipeline strategy), Apple created a product based on a broader platform strategy—an ecosystem that creates value for participants by connecting them across the spectrum, from producers (e.g., app developers) to consumers, while providing the consumer with ever-increasing options and control.

No other industry has seen quite the magnitude of change as healthcare. Today, nearly every facet of the industry is radically transforming as our core business focus shifts from illness to prevention. Providers and vendors are forced to transform their practices as they secure a meaningful role in the industry.

No other industry has seen quite the magnitude of change as healthcare. Today, nearly every facet of the industry is radically transforming as our core business focus shifts from illness to prevention. Providers and vendors are forced to transform their practices as they secure a meaningful role in the industry. After attending a Kansas City Healthcare Communicators Society (KCHCS) educational session, I began to think more about the role of marketers in hospital price transparency initiatives. Participants at the session joined in a lively discussion about consumer expectations for comparative data on healthcare costs. With many

After attending a Kansas City Healthcare Communicators Society (KCHCS) educational session, I began to think more about the role of marketers in hospital price transparency initiatives. Participants at the session joined in a lively discussion about consumer expectations for comparative data on healthcare costs. With many